As the security and smart home market continues to evolve at a rapid pace, the convergence of technology and security has sparked a surge in innovative products and services, each promising enhanced safety, convenience and peace of mind. In the face of this ever-expanding landscape, customers are seeking guidance to navigate the complexities of the market and make informed decisions for their homes and businesses.

Security providers, large and small, face a daunting task of helping customers sort through all of the offers and marketing din. Success in delivering a positive outcome for the customer will largely determine their own fate in the hyper-competitive marketplace.

“Customers like the concept of combining safety — intrusion, fire, video — with convenience — no key households, energy management, app controls,” says Vince Raia, president of EMC Security, Atlanta. “But many customers are forced to reduce their initial wish list when faced with the cost of a fully implemented solution for all of the above.” EMC Security was ranked No. 24 on the 2023 SDM 100 report.

Security Professionals’ Perception of the Intrusion Alarm Market

SDM asked, “How would you rate the current state of the market and the potential for sales in the intrusion (burglar) alarm market?”

When asked about the current state of the burglar alarm market, 47 percent thought it was very good or excellent, up 1 percentage points from the previous year. // Source: SDM 2022 and 2023 Industry Forecast Studies

In Raia’s estimation, solving the dilemma of providing active video monitoring/video verification that really works — and can be provided at a cost that large segments of homeowners and small business owners can afford — could be a game changer for the intrusion systems market.

At the same time, companies are making big bets that the future smart home will incorporate energy generation like solar with smart energy management, with control of myriad smart devices deployed throughout the home.

“If there is a successful intersection of interoperability, ease of use and cost control, customers will be in plentiful supply,” Raia says.

Ahead, industry professionals from across the security, smart home and monitoring ecosystem share their insights and perspectives across a range of these same topics, exploring key growth drivers for technologies and services, sector performance expectations for 2023 and beyond, top channel challenges and more. Included are related results from SDM’s 2023 Industry Forecast, plus other market data, interspersed throughout. Sidebars explore the competitive landscape involving DIY products and broadband providers, as well as monitoring opportunities and the promise of 5G.

Taking the Market’s Pulse

When asked about the current state of the intrusion alarm market, a large majority (81 percent) of respondents to SDM’s 2023 Industry Forecast expressed they viewed it in the range of good to excellent.

For Doyle Security Systems of Rochester, N.Y., that positivity is especially being felt with continued strong growth in the SMB and the large commercial verticals, explains CEO Jack Doyle.

“I believe the continued market consolidation, the increasing operational complexity, has resulted in fewer competitors in the commercial markets,” says Doyle, who is featured on this month’s cover. “So we’re not seeing as much competition out there.”

Video surveillance and access control are driving a lot of the demand for intrusion services and generally being packaged with other advanced offerings, Doyle explains. “When it comes to the residential market, that has continued to be volatile for the last two, three years. We’ve distanced ourselves from the mass market, as we perceive it. Our thesis is that the lifetime value is far greater for residential opportunities that are at the higher end of the market,” he says.

“The hope is that those DIY intrusion purchasers will eventually graduate, if you will, to a more comprehensive intrusion need, and that a company like ours could play a role in being that provider down the road.” — Jack Doyle, Doyle Security Systems

Those consumers who are willing to invest in a more comprehensive intrusion coverage and advanced smart home features, including cameras and video analytics, tend to be the sweet spot for Doyle Security.

“We can get a decent creation multiple,” he adds. “They’re not as inflexible with pricing, they’re still willing to pay a decent recurring for those services. And there’s been less credit risk involved at the higher end of the residential market.”

Clint Choate, senior director-security market, for Snap One, Charlotte, N.C., explains security is a fundamental need in many end user’s eyes, allowing security dealers and integrators to couple intrusion and life safety with smart home tech to deliver the best value.

“To get the best value out of an integrated system, homeowners need professional integrators to deploy,” Choate says.

On the trends front, Choate says, security and smart home panels allow integrators to offer Smart Home as a Service (SHaaS) by bundling smart home products and services with an end user’s monthly monitoring bill.

“We’ve seen more and more of our integrators doing this, and when done correctly, it drives more adoption, lowers the barrier of entry to a consumer, and improves a security integrators’ attrition rate because of the higher perceived value of a system [beyond just security],” he says.

Also, as more smart home devices launch and prices become more competitive, Snap One has seen end users adopting more technologies they may have passed on in the past. “Big tech engagement and DIY products are driving customer awareness,” Choate says. “Smart home devices are not an exception anymore, they are the norm. We have also seen a heightened interest in security, networking and home integration, given the time people are spending in their homes post-pandemic.”

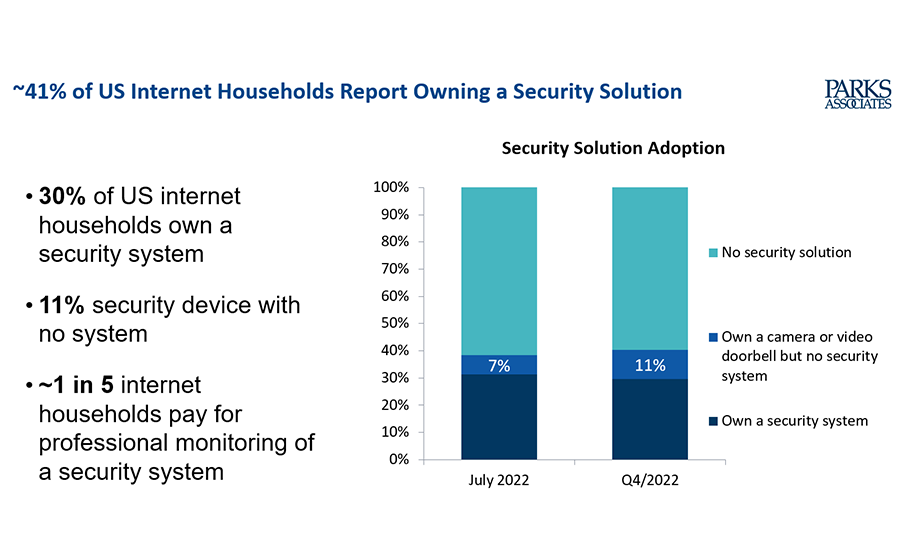

Data from Parks Associates indicates the smart home market continues to experience steady growth. A recent report from the Dallas-based market research firm found 41 percent of internet households in the United States, about 40 million households, own at least one core smart home device, up from 9 percent in 2015.

Steve Butkovich, chief product officer for CPI Security, Charlotte, N.C., says the industry’s home and business security landscape, while positive overall, is not without its challenges. And yet sometimes those headwinds deliver unexpected bounty.

“There’s excitement whenever new technology emerges to meet the evolving needs of new and existing customers, while creating new market space and growth opportunities,” he says. “Earlier this year, the market for new construction slowed as interest rates and inflation spiked. The reduction in relocations and home sales, while challenging on revenue growth, helped improve customer retention and provides CPI with more opportunity to focus on upselling and upgrading existing customers.”

“To get the best value out of an integrated system, homeowners need professional integrators to deploy.” — Clint Choate, Snap One

Marijn van der Wal, CEO of New York City-based DEN Smart Home, a manufacturer of smart locking systems, says one of the most significant trends he attributes to the growth is that the smart home is becoming much more accessible, with products falling into nearly every budget category.

“Take access control, for example. As recently as a few years ago installing any sort of smart lock that could provide guests with digital keys was completely cost-prohibitive, so most often you only saw solutions like this in commercial or hospitality environments,” he says. “Now there are a variety of solutions like our own DEN SmartStrike that provide that same seamless user experience, but it is available at a price point that makes the technology available to consumers on a much broader scale.”

While the smart home market continues on a moderate upward trajectory, there remains ample room for growth and continued adoption. One sector directly impacted by the uptake in smart technologies are multi-dwelling units (MDUs), including apartments, townhomes and condominiums.

“Renters and owners of condominiums and townhomes are embracing the smart home lifestyle,” says Warren Hill, vice president, marketing and partner development, Alula, St. Paul, Minn. “Owners and property managers of apartment complexes are enjoying the benefits of remotely controlling locks, thermostats and lights.”

He continues, “Smart home capabilities in rental properties help managers control expenses — energy management, managing access to individual units and common areas, keep an eye on things with cameras in entryways and other shared spaces.”

Security Professionals’ Perception of the Monitoring Market

SDM asked, “How would you rate the current state of the market and the potential for sales in the monitoring market?”

When asked about the state of the monitoring market, 50 percent of security professionals surveyed for the Industry Forecast consider conditions to be very good or excellent, marking a 10-point increase over the previous year. // Source: SDM 2022 and 2023 Industry Forecast Studies

Robert Gaulden, go-to-market director for Allegion’s Zentra Access brand, Carmel, Ind., explains the multifamily sector is being directly impacted by smart technologies, which can help drive operational efficiencies as well as attract and retain residents.

Popular smart gear, including locks, thermostats, appliances, lighting controls and leak detection, can create new experiences for residents to make their life safer and more convenient, he says.

“These technologies can play a critical aspect with an ever growing technology centric renter base. At the same time, multifamily operators are looking for ways to increase productivity while managing their buildings,” Gaulden explains. “These same technologies can help save time and labor for both vacant units and the total building.”

Gaulden says solutions that both help the bottom line and meet resident needs are absolute winners. Convenience is a huge part of tenants’ day-to-day routines, and smart access control can be an appealing way to cut down on hassle and improve safety for residents and staff alike, he says.

“To enable more property managers to adopt smart home technology, many Proptech providers have introduced property management system integrations, which help reduce the number of systems or databases needed to manage the property and resident experience,” he says.

By example, Gaulden says robust Proptech solutions on the market have an integrated user app that permits residents to access a one-stop shop for everything they need regarding the property and multifamily living. “Through the app, residents can pay their bills, access their own unit and common areas, and control their smart devices. They can also manage their packages and food delivery,” he says.

Video Leads Emerging Tech Pack

Now more than ever, says Travis Miller, vice president of field sales, ADT, Boca Raton, Fla., customers always want to have eyes and ears on their properties, whether they are home or away.

“Our most popular devices to help them do that include video doorbells and cameras that offer recording, two-way talk and remote camera access via the ADT+ app,” he says. “While the excitement around video for home security is not new, video systems becoming more affordable in recent years has really helped video become mainstream.”

Video continues to be the key feature that customers demand as part of their comprehensive home security system, Butkovich says. Demand for the video doorbell has been strong for many years and continues to be CPI’s most popular video product.

“However, sales of our outdoor camera have accelerated in recent years with improved technology via advanced analytics and AI-enhancements,” he adds. “Additionally, our water leak detection and water valve control have seen growth as customers look to protect their home from threats beyond intrusion detection.”

Any video product that provides better quality images, quality of night vision, access to cost effective and instant/easy to access video recording are all key market drivers now and into the future, Raia says.

Almost 50% of dealers say DIY attracts a different customer and new revenue opportunity. // SOURCE: PARKS ASSOCIATES

“Customers like AI that works to reduce video noise traffic, such as unwanted notifications and assists in search of events,” Raia says.

“Verified video through central stations and customer interacting with an alarm signal will continue to increase as police departments are challenged with timely response to alarms.” — Vince Raia, EMC Security

Customers also expect interoperability between purchased devices, Raia explains, and they want to choose best of class for each technology. Also desired by consumers: They prefer to have everything on one — and possibly — two apps.

“After video, other technologies seem to drop off dramatically, possibly due to cost of adding the technology or fear that they will be too complicated to operate,” Raia says. “Door locks are still in high demand, as are thermostats or energy saving devices. In southern states, like Georgia, where power is still relatively inexpensive, the demand and use of controllable devices like thermostats for energy management is not what we would have expected. As cost of energy rises, demand for greater control should also increase.”

Raia is also keeping watch to see if customers are as interested in flood detection and leak management as State Farm’s $1.5 billion investment in ADT last year would imply. “It appears that State Farm is willing to invest heavily in placing the technology in customer’s homes to protect against claims,” he says.

Flood detection and related mitigation devices is an area Doyle is watching with interest as well. Valve shut-off mechanisms in particular are gaining in popularity, he says, driven by insurers incentivizing customers to add these protections to their homes and businesses in exchange for premium discounts.

Security Professionals’ Perception of the Smart Home Market

SDM asked, “How would you rate the current state of the market and the potential for sales in the smart home/home entertainment system market?”

When asked about the state of the smart home/home entertainment market, 70 percent of security professionals surveyed for the Industry Forecast consider conditions to be good to excellent. // Source: SDM 2023 Industry Forecast Study

“We’ve been somewhat slow to adopt those offerings, but our customer base has really kind of dragged us into it,” Doyle says. “We’re hearing more and more customers requesting these types of services. Flood-detection devices have been around for a while, and we’re very comfortable with those. The valve shut-off devices we are somewhat new to, and we’re getting more comfortable with them as we’re going on. Just the state of the technology is such that they’ve become more reliable and more robust and more trustworthy. So we’re beginning to move those. And we see that as a fairly significant change in the residential market.”

NAPCO Security Technologies, Amityville, N.Y., views ongoing advancements in cellular technology and wireless communications as major drivers, according to Judy Jones-Shand, vice president, marketing. Today’s homes have much improved connectivity, Wi-Fi, mesh/network repeaters, better internet speeds and far higher data rates than just a few years back, she notes.

Much of these improvements came as a direct response to consumers’ increasing bandwidth consumption during the COVID-19 to stream video and content of all sorts, meet work-from-home connectivity demands and to a much smaller extent, to control systems, lighting and appliances, she says.

“The government took steps to bring better connectivity to even the most rural areas,” Jones-Shand says. “This too will help enable and spread the adoption of more smart home technology. For those returning to traditional offices, leaving homes and assets vulnerable, security and remote surveillance/monitoring has become more key and in demand, and is another driver of the smart connected home and security market segment — again, video-centric and bandwidth intensive.”

The advancement of connected technology coupled with various levels of complexity and price points are increasingly making available smart home products for those on a budget and those who want the best-of-the-best, Choate explains.

“In recent years we have seen a shift of focus to ongoing software enhancements,” he says. “Companies are finding ways to make existing hardware more compatible, more functional and more advanced. This may lead to more robust products upfront that can be upgraded in the future.”

Another common scenario Choate describes is evolving a smart home system over time. An end user may not know what they want in their smart home from day one.

“They may start with a security and smart home panel and source audio from the store, pick up smart light switches from the hardware store, and get a smart thermostat from their utility provider,” he says. “Security integrators can win in this space by providing open platforms that give end users the most flexibility to integrate with many brands and allow them to add their own devices.”

Greg Mora, executive director product management, security products, Johnson Controls, Milwaukee, Wis., echoes the sentiments of security professionals across the ecosystem when projecting emerging technology: The future of the smart home market will heavily rely on artificial intelligence (AI) and machine learning to further automate and secure our lives while at home.

“AI-powered devices and systems will learn user preferences and behaviors, adapt to individual needs, provide personalized experiences, automate certain tasks, enable sound, voice, and video analytics, and even make intelligent decisions based on that data, all of which will make our lives easier, more secure and more sustainable,” he says.

Current vs. Future Product/Service Offerings

SDM asked security dealers what products and services they offered now and plan to offer in the future. For smart home/home entertainment systems:

Nearly half of SDM 2023 Industry Forecast respondents either currently offer/sell/install smart home/home entertainment systems or plan to within the next two years. // Source: SDM 2023 Industry Forecast Study

Mora goes on to explain these intelligent devices will also automate reporting on the health of connected products in the home, reducing inconvenience and cost of service.

AI is something that everyone is watching closely and looking into its different disciplines, says Abe Kinney, senior director of product management, Alarm.com, McLean, Va., These include large language models (LLMs), a type of AI algorithm that uses deep learning techniques and massively large data sets to understand, summarize, generate and predict new content. Other disciplines under the AI umbrella are computer vision, chat-based interfaces and voice recognition/audio. All of this technology has a place today and will magnify customer capabilities in the future, Kinney says.

“We are excited about the breadth and depth of the devices that can be added to make it truly a smart home, and how it can be a natural complement to the way people go about their lives,” Kinney adds. “People are no longer seeing the smart home as a gadget and are recognizing how it can create a seamless experience when they synchronize their security system and home automation. For example, new features like smart arming, go beyond scheduled arming and disarming to intelligently adapt to daily routines and can auto-arm and disarm Alarm.com powered home security systems based on user activity.”

AI — whether augmented or not — is the future of the smart home market, says Mitch Klein, Z-Wave Alliance executive director. “The industry is already displaying all the signs of where we’re heading.

“For the past several years, the Z-Wave Alliance has discussed the ‘contextually aware’ smart home, which is a system capable of adjusting an environment by selecting from a pre-determined set of outcomes based off data collected by numerous remote sensors deployed throughout the home,” Klein says.

The future of the smart home will consist of moving contextually aware solutions to a higher level. In this future, he describes, an AI-based system will not require a list of pre-determined outcomes but rather, be capable of creating its own in direct response to external environmental stimuli.

“Over time, the industry will see these advanced AI-based systems react, in real time, to events such as break-ins, power outages and others that directly impact the installed system,” Klein says.

Healthy Market Not Without Headwinds

For all of the security and smart home market plusses, installing security contractors and manufacturers interviewed for this story cite multiple significant challenges they are having to navigate to meet end-customer needs and business climate headwinds.

For starters, Kinney says, it can be difficult to tell the residential and smart home story to someone who doesn’t have it currently or appreciate the full value of what the smart home can offer. But once the homeowner does, the technology becomes something they can’t live without.

“For example, it might be hard to get someone to try a smart lock for the first time, but once they do, they will never want to go back to carrying their house keys again,” he says. “We know that skilled technicians are in demand and continue to look at new ways that Alarm.com can help technicians successfully set up a smart home. We want to provide tools and resources so it’s easy to say ‘yes’ to any smart technology that a customer might want in their home.”

Snap One’s Choate cites cost and privacy as the primary challenges hindering widespread adoption. Smart home devices can be expensive, which deters some people from getting started. Where privacy is concerned, end users are weary of big tech companies being a part of their home or hackers gaining access to their systems, he says.

“As smart home technology has become more commonplace and standardized, platform and service will be critical in widespread adoption,” Choate adds. “Leading consumer brands have shaped user expectations to expect easy-to-use and cost-effective solutions. This challenges traditional integrators to provide a superior product with superior service.”

Johnson Controls’ Mora shares Choate’s view pertaining to top sector obstacles hindering widespread adoption of smart home technologies.

“Affordability remains a barrier as creating a smart home ecosystem typically requires both an upfront investment and recurring monthly expenses, including subscriptions, maintenance and upgrades,” he says. “While smart home ecosystems can save customers in the long run, often it is years before those cost benefits are realized. Security and smart home providers need to continue to offer bundling and finance options to help reduce this barrier to entry.”

Mora explains as devices become more intelligent, industry shifts will favor their applications. For example, investing in a smart home water management solution will become attractive to consumers who will then qualify for reduced insurance premiums.

Top Residential Niches

SDM asked, “In which one residential market segment do you expect to see the highest rate of revenue growth in 2023?”

Existing middle-market homes top the list of residential segments 2023 SDM Industry Forecast respondents expect to see the highest revenue from this year. // Source: SDM 2023 Industry Forecast Study

As smart home ecosystem options continue to expand, Mora also stresses that consumers are acutely aware that it could put their sensitive information at risk for unauthorized access and potential misuse. “Addressing these concerns and implementing robust security measures are essential for widespread adoption,” he adds.

The industry’s most-needed force for increased adoption is renewed focus on end-user education, says Nick English, CEO of Kaadas North America, Seattle, Wash., a manufacturer of smart lock solutions.

“We need to evolve beyond the security professional being the best advocate for these types of solutions to a reality where customers are getting served information about the advantages and benefits of smart home and security technology through a variety of channels,” he explains.

Looking at the state of the smart home market through the lens of the adoption stages chart, English says, the industry still has not made the full jump from “early adopter” to “mainstream adoption,” despite significant progress over the past several years.

“It is our belief that we’re on the threshold, however, and that continued efforts in education, specifically related to real-world examples, is the best path forward to achieving widespread adoption,” he adds.

English also explains that in order to keep pace with the demands of users, now is an excellent time to introduce new products, new technologies and new brands. That said, there are two competing forces at odds that those within the security industry will have to strike a balance between in order to remain successful and relevant.

“On the one hand, there’s pricing control and navigating the supply chain disruptions and shortages to help ensure that the price of products and solutions do not get out of hand or locked out of being included in security packages or installations,” he explains. “On the other hand, there is the desire for more features, benefits and technology to be integrated into new solutions. Those two forces run in opposite direction of each other. As you battle to keep the cost of a product down and reasonable, every advanced feature or benefit works to drive the cost of the solution up.”

This means manufacturers within the space will have to work harder than ever to strike a balance between solutions that are feature-rich yet affordable in order to remain relevant within the industry, English says.

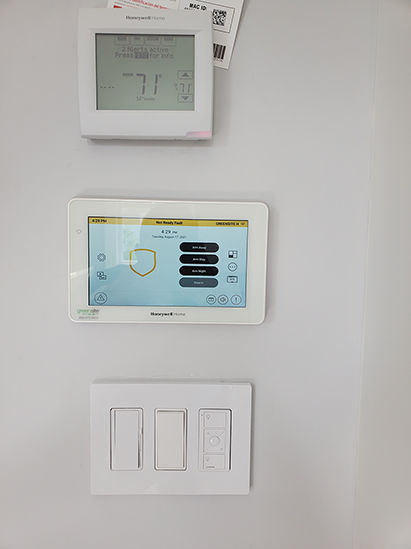

While smart home devices are more affordable than ever, many devices can still carry a significant price tag, says Daniel Metzger, director of operations for Greensite, a security and home automation provider, located on Long Island in New York.

“Added in with a professional installation and the need to create a profit, these products can tend to fall out of the consumers’ price range,” he says. “However, judging by the current trend in smart home consumption, we anticipate the prices will continue to drop.”

Intimidation, Metzger says, also seems to be one of the most significant marketplace challenges. Complicated devices and platforms tend to send customers running in the other direction. Simplicity is key to overcoming this obstacle.

“Apps like Resideo’s Total Connect or the all-in-one platform by Brilliant offer the user a one-stop shop without the complications presented by other platforms,” he says.

To mitigate the intimidation factor, Greensite finds it is paramount to spend as much time as is necessary educating the customer from the first introduction through the install and, most importantly, the final walk through.

“We will not leave a customer’s home without having them perform several dry runs with their system and automation,” Metzger says.

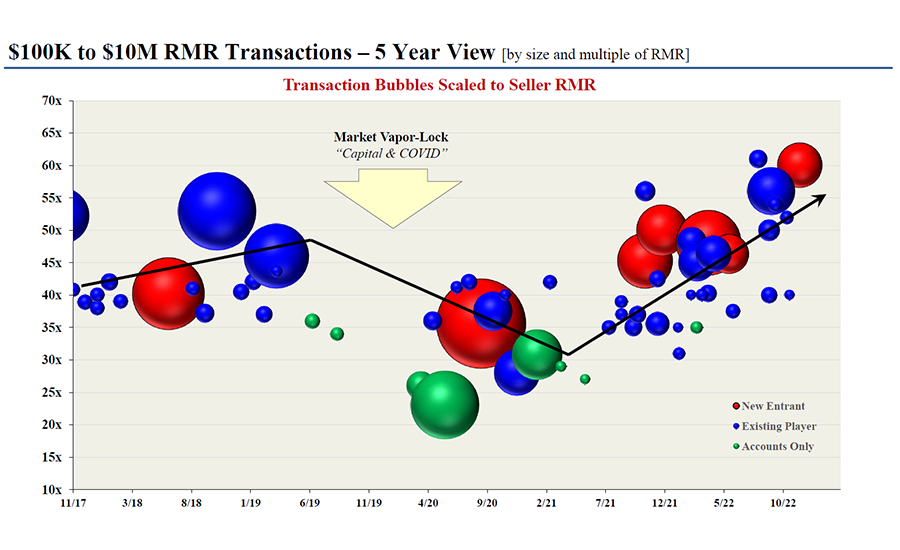

Raia of EMC Security says the intrusion market is as competitive as he can ever remember in his 25 years with EMC. Technology options have expanded, and buyers now have the choice to forgo traditional intrusion alarm response technology in favor of using video-only notification and self-monitored options, he explains.

“There is a lot of marketing being done that is confusing for buyers trying to navigate the myriad choices of companies and technology that will best suit their needs,” Raia says. “Demand for intrusion services may be up overall, but with the segmentation of the market by new entrants and new technologies, growth may be a challenge for many dealers. Our own experience is the cost of lead generation and cost of new customer acquisition continues to increase each year.”

54% of dealers report support costs have jumped. // SOURCE: PARKS ASSOCIATES

Customer sales interactions require more time to determine need and present all of the new options, Raia explains further. Installation and service teams must be able to support and work with multiple technologies and be familiar with home networks. Tech support teams must be available after the sale to support customers and the new technologies.

“I would expect traditional security models will continue to be displaced with new technologies, including video-only systems with notification and cloud storage options,” he says.

Elizabeth Parks, president and chief marketing officer of Parks Associates, invokes marketing as a particular challenge for smaller independent security providers. The sector’s influx of tech giants, national marketers, insurance providers, among a litany of other disruptors, are making it increasingly difficult to differentiate and be heard above all the din.

“The local security players are having trouble over national, and I think that is going to probably remain somewhat the same,” Parks explains. “Some of that reflects the buying patterns of consumers and the shift to the online purchase. If you Google ‘security’ you're going to probably get SimpliSafe or Ring. And then you’re going to get ADT or Brinks. So if you’re a smaller local player, you really have to do a lot of work in the digital marketplace to show up. And that’s hard; it costs money and marketing.”

With a flood of devices in the marketplace, dealers are also confronted with a vexing issue of trying to explain all the bells and whistles to their customers, Parks says. Therein lies the education conundrum — packaging a solution and selling it to the consumer in a way they can understand.

“That is what everybody is trying to figure out, ‘How do I do this?’ But it is worth pursuing because our data does show from dealers that with all the attached devices — and adding in video storage, monitoring and network cameras and these different things — that you can get a 25 percent increase in RMR a month because of the interactivity that’s getting added,” Parks says. “And so in some ways, we’re seeing fewer subscribers of systems but more money. The focus has to be on the base of customers. How do you go to your customer base and upsell or somehow convince them to buy more to get more money? The challenge is going to be some of the legacy systems out there and how do you convert them?”

61% of dealers report remote diagnostics for inbound smart home support issues. // SOURCE: PARKS ASSOCIATES